Your Legacy: Ensure a Sustainable Future for Colorado and Beyond

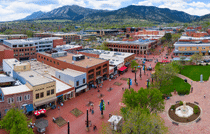

In 1976, Eco-Cycle volunteers launched the state’s first curbside recycling program, making Boulder one of the first cities in the US to pilot curbside recycling. Over the decades, donors like you have helped Eco-Cycle make tremendous advances to build less wasteful, more resourceful communities, including expanding recycling and composting services across the state, founding the nation’s first Center for Hard-to-Recycle Materials, piloting carbon farming and compost infrastructure, and championing statewide policies to curb plastic pollution and to make recycling free and accessible to ALL Coloradans.

Together, we have made tremendous Zero Waste advances to conserve resources, curb pollution, protect habitat, and create more sustainable, equitable, and climate-resilient communities. Including Eco-Cycle in your planned giving is one of the most significant ways you can ensure a Zero Waste future for the next generation.

Here are three different ways to give:

- Include Eco-Cycle in your will

- Make a tax-free charitable gift from your IRA

- Name Eco-Cycle as a beneficiary

Read on to learn more about each option!

Option 1: Include Eco-Cycle in Your Will

An excellent way for you to support Eco-Cycle’s mission is to leave us a bequest in your will or living trust. You remain in control of your assets during your lifetime, and in most cases, you can change your beneficiary or gift amount at any given time. Sample language for your will or living trust:

“I bequeath to Eco-Cycle, Inc. (Tax ID #84-0730811), a nonprofit organization at 6400 Arapahoe Rd, Boulder, CO, 80303:

- the sum of _________ dollars; or

- an amount equal to ________ percent of the net value of my estate; or

- all (or a percentage of) the rest, residue, and remainder of my estate.”

- If you would like to designate your bequest to a particular program, you can add: “It is my request that this gift be used for the benefit of [specify program].”

Option 2: Make a Tax-Free Charitable Gift from Your IRA

If you are 70½ years old and have an Individual Retirement Account (IRA), you can make an annual withdrawal of up to $100,000 directly from your IRA and distribute those funds to one or multiple charities, using a Qualified Charitable Distribution form obtained from your IRA administrator. Or, you can designate beneficiaries to your IRA (see “Name Eco-Cycle as a Beneficiary,” below).

Giving to Eco-Cycle from your IRA maximizes the impact of your legacy giving, as IRA funds distributed to 501c3 charities are not taxed—meaning 100% of your funds are available to support Eco-Cycle’s mission and work.

Option 3: Name Eco-Cycle as a Beneficiary

Naming Eco-Cycle as a beneficiary of your IRA*, life insurance plan, bank accounts, donor advised funds, and/or other assets by simply updating your beneficiary designation form. Go online or request a beneficiary designation form from your plan provider to include Eco-Cycle as a full or partial beneficiary. Contact your financial advisor (a financial planner, lawyer, or accountant) and ask for help in establishing a charitable gift.

*Giving to Eco-Cycle from your IRA maximizes the impact of your legacy giving, as IRA funds distributed to 501c3 charities are not taxed—meaning 100% of your funds are available to support Eco-Cycle’s mission and work.

TAX-DEDUCTION INFORMATION

You may need to provide your financial advisor and/or attorney with the following information:

- Physical Address:

Eco-Cycle, Inc.

6400 Arapahoe Rd.

Boulder, CO 80303

- Mailing Address:

Eco-Cycle, Inc.

P.O. Box 19006

Boulder, CO 80038

- Tax ID / Employer Identification Number (EIN):

84-1113831

Non-profit status: 501(c)(3)

Let Us Know About Your Plans

By notifying us of your intention to include Eco-Cycle in your planned giving, we are able to thank you and ensure your gift is designated to the work or programs that mean the most to you. If you would like to remain anonymous, we will be sure to abide by your wishes. To notify us of your intentions, please contact Anna Leske, Philanthropy Manager, at [email protected], or complete the form below: